Highlights:

- It’s essential to automatically retrieve information from both internal and external systems to ensure immediate visibility across your entire risk landscape.

- Effective governance, risk, and compliance GRC necessitates engagement from every individual within the organization and should extend beyond the confines of the risk and compliance team.

Recently, we have gone through unknown difficulties like pandemic, threats to the global order, and climate change. Currently, we are facing inflation, higher interest rates, and last but not least ‘recession.’

When business leaders are not sure about the future, they frequently play it safe by cost-cutting and being careful with investments. But simply playing defense cannot give full safety.

In times of uncertainty, it’s essential to ensure your business is ready to tackle any difficult challenge. And when things get better, it’s crucial to take advantage of golden opportunities for growth to fight back strongly from economic downturns.

So, how do you recession-proof your business to earn customer loyalty and stability?

As a business person, you should not wait for the ideal time to employ techniques and technologies that mitigate risk, enhance efficiency, cut costs, and sustain growth.

Organizational resilience provides a significant competitive edge.

Research demonstrates that resilient enterprises bounce back faster in tough times. For instance, Boston Consulting Group’s recent study revealed that around 30% of a company’s total shareholder return is influenced by its crisis performance.

It shows that resilient firms reduce crisis impact and heal quicker. They have better immunity compared to their less-prepared counterparts.

So, maintain your financial health with recession-proof businesses. Here, we will dig into three considerable challenges currently confronting businesses. Also, the effective solutions to help organizations improve organizational resilience, cut costs, and gain customers’ faith.

-

Business Challenge: The High Costs and Challenges of Fragmented Risk and Compliance Systems

Risk and compliance teams frequently struggle with fragmented applications and processes, compelling them to buy software licenses from various vendors and manage multiple systems. This fragmentation results in high ongoing expenses, a dissatisfactory user experience, and heightened labor costs.

Way out: Cut costs through application rationalization and consolidation

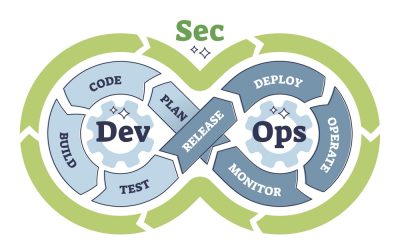

A set of integrated applications tackles business challenges by consolidating disparate governance, risk, and compliance (GRC) tools onto one platform.

This consolidation reduces licensing and maintenance costs and enriches the user experience by providing a continuous and connected interface across the risk organization and throughout the entire business.

For existing customers, leveraging expertise can streamline GRC applications. Also, using software asset management can tally the broader range of deployed applications and associated licensing costs. It also allows for a risk-based approach to rationalization based on services’ business impact and criticality.

-

Business Challenge: Streamlining Risk Management Processes

Many resilient firms have implemented business-wide processes to tackle emerging risks, but manual and inefficient methods often inflate costs.

Conversely, less resilient entities tend to isolate risk and compliance, leaving major gaps in their defenses. With the current trend toward outsourcing and reliance on third parties increasing, the challenge of streamlining risk at scale becomes urgent. To recession-proof your business and attract loyal customers, you must engage with the below way out.

Way out: Enhance efficiency and mitigate risk through self-service options

Successful GRC requires involvement from every person in the organization. It should not remain limited to the risk and compliance team.

- Business leaders must oversee controls

- Employees must adhere to policies

- All must identify and report emerging risks promptly

In essence, risk management should be integrated into the daily responsibilities of all employees.

Additionally, recession-proof business to gain customer loyalty, enhance your risk readiness, and cut costs by integrating risk management into daily operations with self-service options:

- Empower business leaders to take charge of controls with tools for creating, managing, monitoring, and verifying controls.

- Increase policy visibility by publishing them on employee platforms and enforcing these policies efficiently through role-based interfaces and automated approval processes.

- Engage all employees in risk management by providing self-service tools for reporting risks, improving transparency, and eliminating manual reporting costs.

- Strengthen vendor assessments and reduce expenses with dedicated portals automating assessments, facilitating collaboration, and tracking issues to resolution.

- Provide anytime, anywhere self-service through streamlined experiences accessible on web and mobile devices.

- Simplify day-to-day tasks for employees while mitigating company risks, such as requesting policy exceptions, reporting incidents, and managing vendor assessments.

-

Business Challenge: Compliance Breaches and Financial Loss

To minimize risk and guarantee compliance, rapid detection and prompt response are imperative. However, many entities depend on periodic audits, both internal and third-party, to initiate their responses.

While audits are essential for resilient organizations, solely relying on them to prompt responses exposes you to significant financial consequences.

- Compliance failures can come up with hefty costs, especially when regulations are involved. For instance, Meta (Facebook) faced a fine exceeding USD 900 million for GDPR privacy violations.

- Even without regulatory oversight, compliance breaches can lead to significant financial losses. For example, if noncompliance exposes you to a cyberattack, downtime costs can reach hundreds of thousands of dollars per hour.

Way out: Enhance visibility, expedite responses, and evade financial penalties through ongoing monitoring

Proactive visibility is needed to prevent these substantial costs. Integration of risks and controls into daily operations allows for consistent real-time monitoring.

Automatical information retrieval from internal and external systems is also necessary to grant instant visibility across your entire risk landscape. This includes aggregating data from various third-party risk management providers.

In the end, businesses must employ such recession-proof business ideas to get stability.

Last Lines

As businesses confront uncertainty, they are trimming expenses and closely analyzing their investments. While this is a sensible and essential reaction, it must be complemented by a commitment to building organizational resilience.

Investing in organizational resilience presents a dual benefit. It not only mitigates risk, enabling you to navigate turbulent times and rebound swiftly for a competitive edge when conditions improve but also serves as a cost containment strategy. It makes you the best recession proof business.

By enhancing productivity and efficiency, organizational resilience reduces existing costs and prevents the substantial expenses associated with business interruptions and regulatory fines resulting from non-compliance.

Enhance your understanding by delving into various technology-related whitepapers accessible through our resource center.